This small cap has 237% revenue growth: Mangalam seeds

Overview:

Mangalam Seeds Limited specializes in the production and distribution of high-quality seeds, primarily focusing on forage crops. With their expertise in supplying hybrid seeds that are resistant to diseases, pests, and droughts, the company caters to diverse agro-climatic conditions. The remarkable growth in the company’s stock value indicates a positive trajectory for its financial performance.

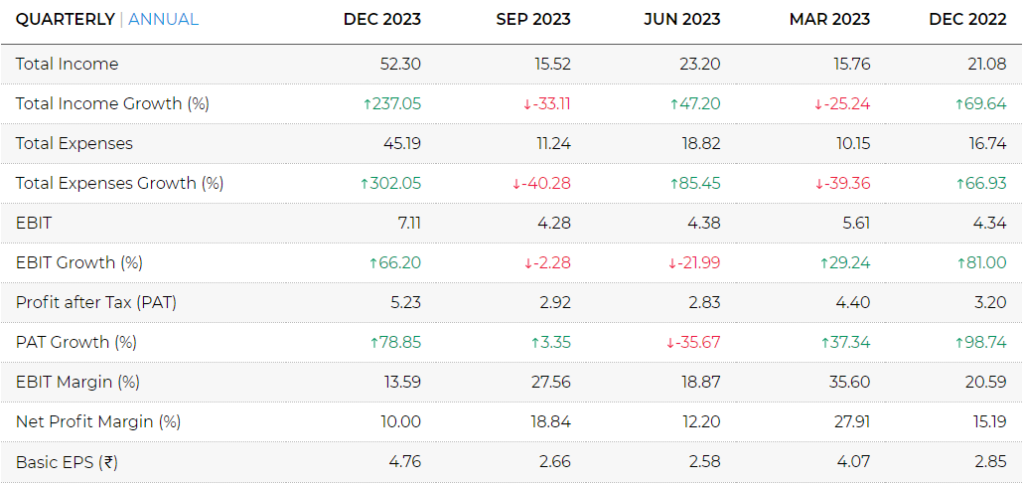

Financial Performance:

- Stock Performance: This small cap agriculture stock experienced a remarkable surge of 12% to reach Rs. 305. Over the past year, the stock has seen an impressive increase of 56.51%, and over the last three years, it has grown by a substantial 341.79%.

- Revenue and Profit Growth: From September 23 to December 23, Mangalam Seeds Limited showcased impressive quarterly revenue growth of 237.05%, accompanied by a corresponding profit growth of 78.85%. Furthermore, the company’s annual revenue growth of 59.93% surpasses its three-year compound annual growth rate (CAGR) of 17.3%.

- Return on Equity (ROE): With a robust ROE of 19.55% for the fiscal year ending March 31, 2023, Mangalam Seeds Limited outperforms its five-year average of 14.31%. This highlights the efficient utilization of shareholder funds to generate profits.

Leadership and Technical Expertise:

Dr. I.D Patel, M.Sc (Agri), Ph.D. in plant breeding and genetics, leads Mangalam Seeds Limited with his extensive experience and expertise in agriculture. As an eminent agricultural scientist, Dr. Patel has made significant contributions to the state and national levels of agricultural development. With a teaching and research background spanning 42 years, he has played a vital role in developing 46 improved/hybrid varieties and has published 41 research papers in national and international journals. Dr. Patel’s leadership brings credibility and technical depth to Mangalam Seeds Limited.

Shareholding Pattern and Market Dynamics:

Small cap stock Mangalam Seeds Limited boasts a stable shareholding pattern that is dominated by promoters and retail investors. However, the company’s growth trajectory may face challenges or opportunities due to the limited participation of domestic institutional buyers or foreign investors.

Industry Challenges and Opportunities:

- Competition: Mangalam Seeds Limited faces significant competition in the agriculture sector. While competition encourages innovation and market dynamics, it also requires the company to stay agile and continuously enhance its offerings.

- Market Sensitivity: The agriculture sector in India is highly sensitive to various factors, including government policies and socio-political movements such as ongoing farmer protests. These external factors can impact the company’s sales positively or negatively, necessitating a proactive approach to navigate market dynamics.

Conclusion:

Mangalam Seeds Limited, a promising small cap agriculture stock, demonstrates strong financial performance with robust revenue and profit growth. Its seasoned leadership team, led by Dr. I.D Patel, provides expertise and credibility to the company. Despite industry challenges and market sensitivities, the company’s strategic focus on innovation and adaptability to changing climate conditions positions it well for sustained growth in the agricultural sector. Further details about the stock can be found on the website https://www.mangalamseeds.com/

Disclaimer: This report is based on available information and analysis as of the specified date. Investors are advised to conduct further research and consult financial experts before making investment decisions.