This penny stock shows 100CR of annual profit!

Business Overview:

Company is engaged in the business of owning, purchasing, selling, leasing and developing real estate including land, plot, buildings, factories, warehouses, residential, commercial, agricultural and industrial infrastructures. Company also deals in immovable properties and other related assets as owners, advisors, developers, service providers and brokers. More details about the stock can be found HERE.

RECENT BULL RUN :-

The stock price is in a constant bull run since November 2023. Being at Rs. 53/share the stock is now touching 200 mark in just 5 months. The stock has been hitting upper circuits straight from 4th April 2024.

IS THIS STOCK UNDERVALUED??

Looking at the company financials, the company is showing tremendous return for last three years. There is a 450% rise in sales figure on Y-o-Y basis. The company is booking healthy profits. From being at a loss of 2 crores in 2021 the company is showing 100cr of profits in the current year. The company is operating 94% of its profits from its main operation.

The company seems to be focused on future growth as well, Company has used Rs 34.41 cr for investing activities which is an YoY increase of 54.84%. (Source: Standalone Financials)

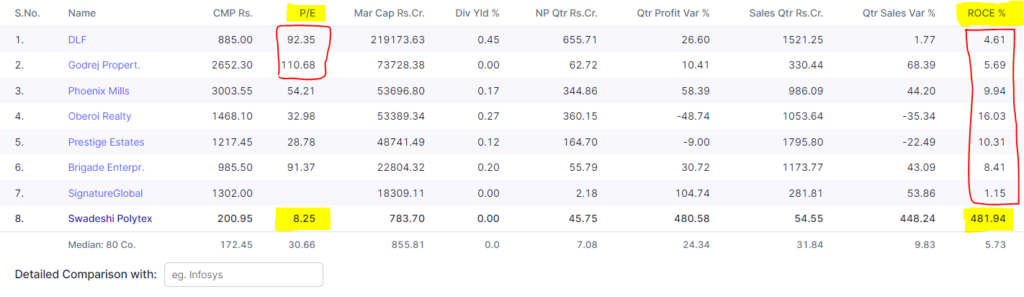

The main metric which makes this stock very interesting is its valuation. The company is only valued at 784cr, which makes the company trading at a P/E ratio of mere 8.25. This PE ratio is considered very lucrative by big investors like Warren Buffet.

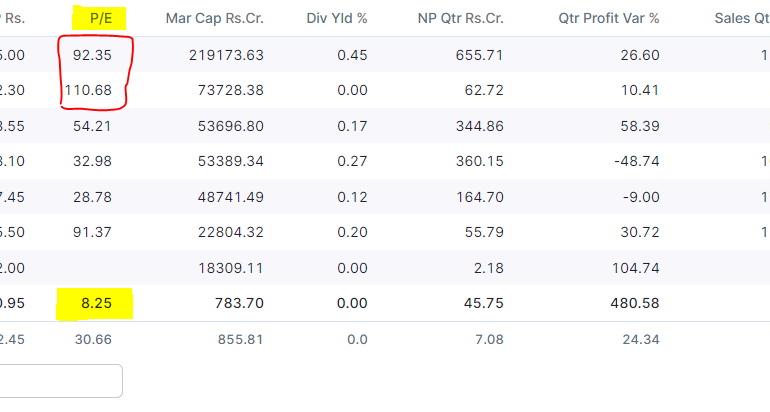

PEER COMPARISON :-

The peer comparison again brings a very good picture for the company. The average sector P/E is at 42.69. With peers like DLF and GODREJ PROPERTIES there is a huge gap in company ratios. Apart from P/E ratio, The company is showing magnificent ROCE%. With 481.84% ROCE, it is highest among the peers.

Disclaimer – This is not an investment advice, do your own research and analysis. For more such blogs visit STOXINSIGHT.