STOCK HAS LOST 44% MCAP IN JUST 40 DAYS!!

BUSINESS OVERVIEW:

Company is registered as a Non-Banking Financial Company with a presence in over 200 cities. It offers a range of solutions and services in multiple financial asset classes including brokerage services. Company is engaged in capital and debt market related activities viz. merchant banking, institutional equity, wholesale debt market, retail debt market, PF Advisory, research, retail equity, distribution and depository services of financial products (mutual funds and insurance). Group operates its merchant banking division only for the debt placements. You can visit company website from this link for more information on the stock.

RECENT DEVELOPMENT:

This stock is seeing a downfall in prices since 7th February 2024. Since then the price has fallen from 266.95 to Rs 149/share. This is almost 44% drop in market valuation in a very short time frame. The company is now valued at Rs.188cr.

As per the economic ratios, this company can be considered very cheap. The stock PE is only 4.04 and with an annual profit of 13cr in 2023 the EPS is touching 37. Which is a very healthy sign that the company is in the undervalued zone.

REASONS FOR THE DOWNFALL :

The reason for the steep downfall of the company can be related to two primary things –

- Declining profits and sales: Company is showing decline in sales and profit since 2021. The profits stood at Rs 61 crore in 2021 and only 14cr in 2023. Same story is seen in sales, dropping from Rs 71cr to 20cr only in 2023.

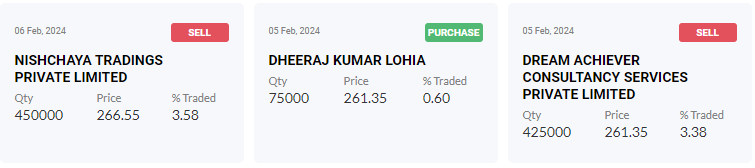

- Investors exiting: The price downfall is very related to the number of investors exiting the stock. The list for the recent exits are as follows.

- NISHCHAYA TRADINGS PRIVATE LIMITED sold stock worth 11.99 cr. valued at 266.55/share on 6th February 2024.

- DREAM ACHIEVER CONSULTANCY SERVICES PRIVATE LIMITED sold stock worth 11.10 cr valued at 261.35/share on 5th February 2024.

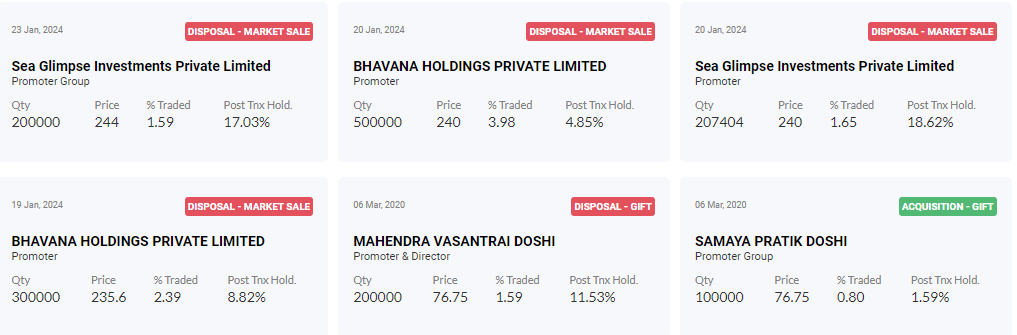

- Sea Glimpse Investments Private Limited and BHAVANA HOLDINGS PRIVATE LIMITED sold stock worth 28.92cr between 19th January and 21st January 2024.

CONCLUSION:

LKP finance has seen a major reduction in price recently but the financial performance from 2023-2024 shows very promising comeback and a very strong upside in profits.

This company can have a strong comeback looking at the financials and ratios. Stay tuned for more updates on the stock on Stoxinsight.

Disclaimer : This is not a financial advice, do your own research.