SAR auto product’s astonishingly high PE ratio: latest update

Introduction

In the realm of automotive components and real estate development stands SAR Auto Products Limited, a company founded in 1987 by Mr. Ramesh D. Virani. Operating out of Rajkot, Gujarat, this company has garnered attention for both its manufacturing prowess in auto components and its foray into real estate construction. However, recent financial revelations have sparked concerns about the company’s valuation and sustainability.

Company further details can be found on https://www.bseindia.com/stock-share-price/sar-auto-products-ltd/sapl/538992/

Financial Performance Analysis

Valuation Metrics

- SAR Auto Products Limited currently boasts a valuation of 1091(approx) crore, with an annual profit of 0.62 crore.

- A strikingly high price-to-earnings (P/E) ratio of 1197.91 reflects significant overvaluation, standing at 1759.6 times its profits.

- The Return on Capital Employed (ROCE) is alarmingly low at 4.73%, indicating inefficient capital utilization.

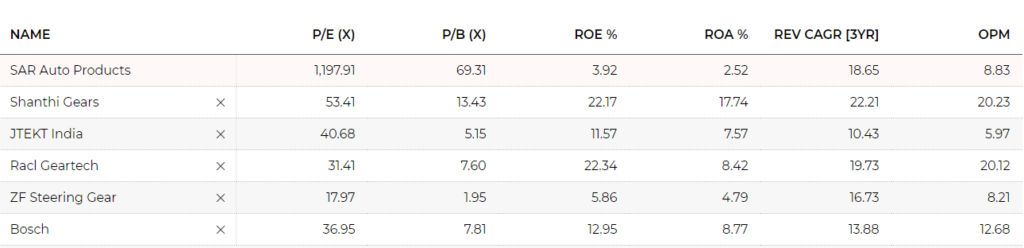

Comparison with Competitors

- When compared to competitors like Reliance and BOSCH, SAR Auto Products Limited’s P/E ratio stands out. Reliance and BOSCH sport P/E ratios of 28 and 37, respectively.

- Using BOSCH’s valuation metrics, SAR Auto Products Limited should ideally be valued at approx 40 crore, hinting at a potential overvaluation.

Warren Buffett’s Perspective

“Price is what you pay. Value is what you get.” – Warren Buffett

- Warren Buffett’s investment philosophy advises looking beyond the P/E ratio and focusing on factors such as management quality, competitive advantage, financial health, and future growth potential.

- Buffett’s preferred valuation metric involves the quality and durability of discounted future cash flows, encouraging investors to assess long-term profitability.

Rising Concerns

Declining Profits

- Over the past year, SAR Auto Products Limited has witnessed a staggering 50% decline in annual profits, dropping from 1.13 crore to 0.62 crore.

- This downward trend raises doubts about the company’s operational efficiency and financial stability.

Promoters’ Share Sell-Off

- Since February 2023, SAR Auto Products Limited’s promoters have been steadily selling shares worth 20 crore, leading to a decrease in their share from 74.01% to 67.91% since June 2022.

- This move raises questions about the promoters’ confidence in the company’s growth prospects.

Conclusion

In conclusion, SAR Auto Products Limited presents a mixed bag of financial indicators, with a concerning high P/E ratio, low ROCE, and declining profits. Despite apparent growth in sales and profits on a quarter-on-quarter basis, the company’s valuation remains inflated. By heeding Warren Buffett’s timeless investing advice and analyzing the company’s specific financial performance, potential investors can navigate the intricate landscape of SAR Auto Products Limited with prudence and foresight.

For more interesting blogs visit www.stoxinsight.com

Disclaimer: This is not a financial advice, do your thorough research before investing.