POOR IPO START BUT INSTITUTIONS ARE BUYING AGGRESIVELY!!

OVERVIEW :

Founded in 1999, Gopal Snacks is an FMCG company dealing in ethnic snacks, western snacks, and other products.

Product Portfolio: The company offers a wide variety of savory products under its brand ‘Gopal’, including ethnic snacks such as Namkeen and Gadhiya; western snacks such as wafers, extruded snacks, and snack pellets; and fast-moving consumer goods including papad, spices, gram flour or besan, noodles, rusk, and soan papdi.

INTERESTING DEVELOPMENTS :

The company recently got listed on stock exchanges on 14th March 2024. With an IPO size of 650cr, the company IPO was 9 times oversubscribed.

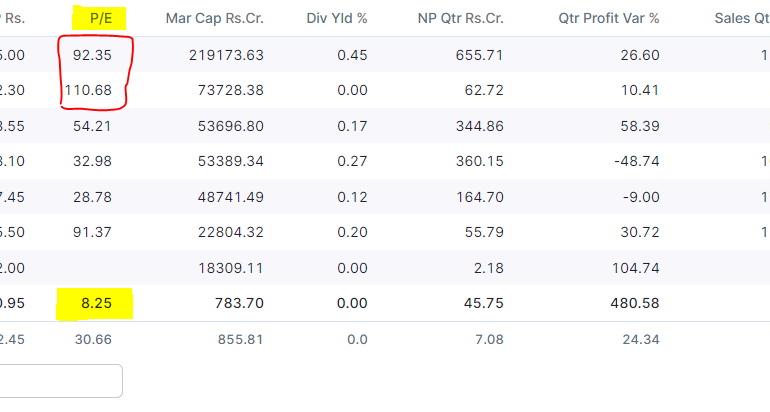

Even though the company saw a slow start in the stock price. The price opened at 12.5% discount from the IPO price. The price closed with a downfall of 9.55%. The poor start could be a timing issue because of the general market condition on 14th march. The stock also took the heat with the indices.

After a poor start in the stock market, GOPAL SNACKS LIMITED is now attraccting new buyers.

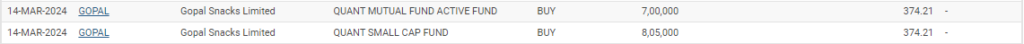

As the bulk deals data on NSE shows that Quant small cap fund bought 8.05 lakh shares at an average price of Rs 374.21, buying Rs 30.12 crore worth of equity shares. Quant Active Fund picked up 7 lakh shares at Rs 374.21 per share, acquiring Rs 26.19 crore worth of shares.

This could be a very big development for the sentiments of the company in the markets. Generally a upside move in price is seen after MUTUAL funds investments.

QUALITY ISSUES :

In the past, co. has received 8 notices from the Food Safety and Standards Act, 2006, alleging substandard products, misbranding, deficient packaging, and misleading advertisements. More details about recent notices can be found on NSE.

Disclaimer : This is not a financial advice, do your own research. For more such latest news, visit stoxinsight.