Narbada Gems & Jewellery Limited: A Tale of Soaring Stock and Hidden Concerns

Introduction: Narbada Gems & Jewellery Limited has recently witnessed an astonishing surge in its stock price, doubling within a mere seven days. With the company’s valuation hitting a remarkable 190 crores from its previous standing of 96 crores, investors are on high alert.

Financial Highlights:

The release of Narbada Gems & Jewellery Limited’s Q3 2024 financials on February 25th has been a game-changer. The company reported a staggering 7.7 times increase in net profit compared to the previous quarter, soaring from 0.56 crores to an impressive 4.32 crores. Furthermore, annual profits have surged by an impressive 92% from 2022 to 2023.

Factors Driving Growth:

The surge in stock price can be attributed to the overwhelmingly positive sentiment surrounding the company’s financial performance. While institutional investors are yet to show interest, high net-worth individuals (HNIs) have been actively investing, propelling the stock to hit upper circuits for five consecutive days.

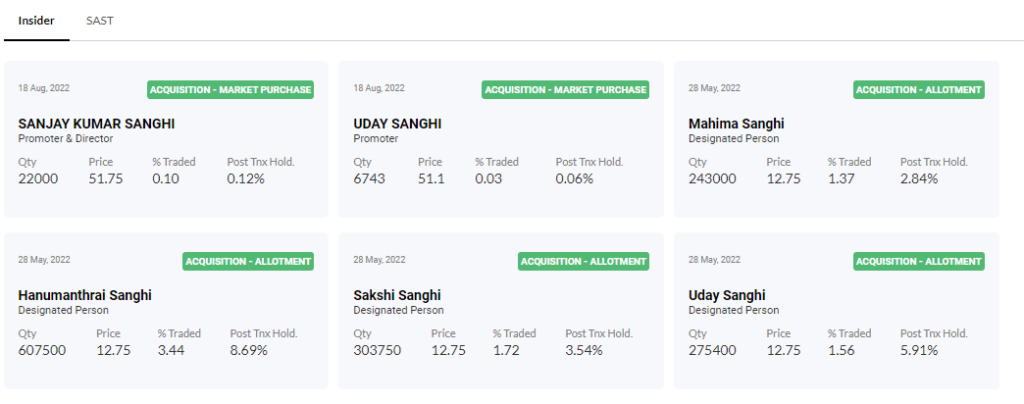

Insider Trading and Promoter Activity:

In 2022, the company’s promoters made significant purchases of 2,053,350 shares at 12.75 rupees each. With the current market price soaring to 93.00 rupees, the value of these shares has surged to an impressive 19 crores. However, there’s speculation that promoters might take advantage of the soaring valuation to offload their shares, potentially impacting the stock price.

Further details can be founds on www.nse.com

Concerns and Considerations:

- Trading at 4.13 times its book value, Narbada Gems & Jewellery Limited’s stock might be overvalued, raising concerns about sustainability.

- Despite reporting consistent profits, the company has refrained from paying dividends, which could disappoint income-seeking investors.

- With a low return on equity of 9.36% over the last three years, questions arise regarding the company’s efficiency in generating returns for shareholders.

- There’s a possibility that the company is capitalizing its interest costs, which could inflate reported profits and mislead investors.

Conclusion:

While the meteoric rise of Narbada Gems & Jewellery Limited’s stock is undoubtedly enticing, investors should proceed with caution. The stock’s astronomical valuation, coupled with underlying concerns regarding dividend payouts, return on equity, and potential interest capitalization, necessitates a thorough evaluation before diving into investments.

For other interesting stocks latest updates visit stoxinsight.com

Disclaimer : This is not a investment advice, do your own research before investing.