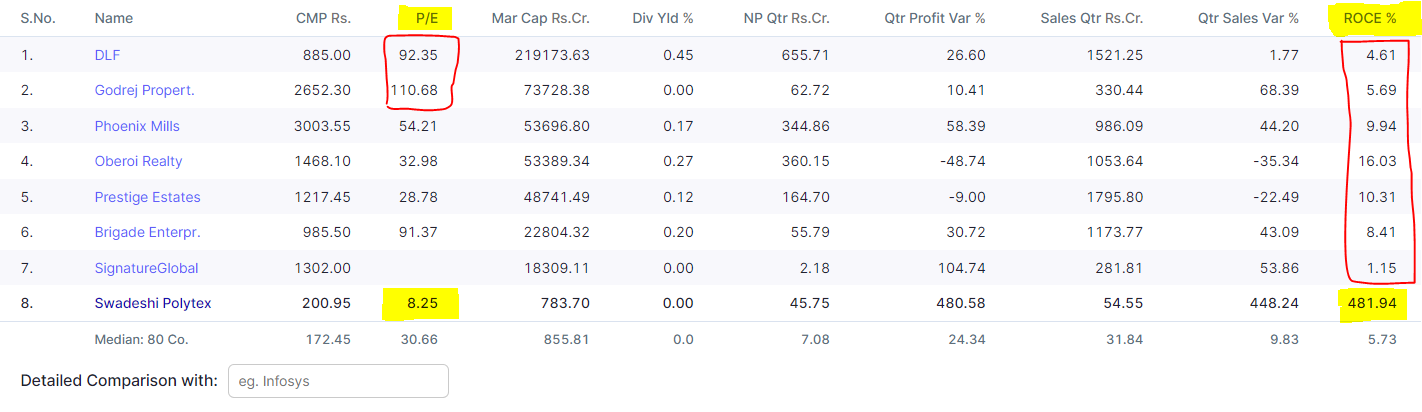

This penny stock shows 100CR of annual profit!

Business Overview:Company is engaged in the business of owning, purchasing, selling, leasing and developing real estate including land, plot, buildings, factories, warehouses, residential, commercial, agricultural and industrial infrastructures. Company also deals in immovable properties and other related assets as owners, advisors, developers, service