1050% profit growth coming up in this midcap pharma stock!!

1. Surge in Stock Price and Volume:

In recent weeks, SMS Pharma has experienced a significant surge in its stock price, skyrocketing by approximately 40%. This remarkable rise has coincided with a surge in trading volume, drawing attention to the company’s dynamics. GRAVITON RESEARCH CAPITAL LLP, a prominent market participant, has been actively involved in these trades, executing an average daily turnover of around 5 lakh shares. Their involvement, including intraday transactions, underscores the heightened activity surrounding SMS Pharma’s stock.

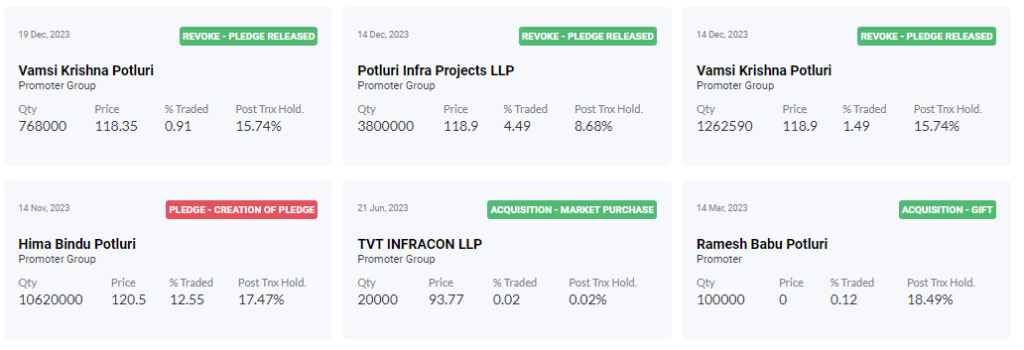

2. Promoter Actions and Pledged Shares:

A noteworthy development involves the promoters’ decision to revoke a portion of the shares pledged in November 2023, signaling a move to address concerns over pledged shares. While this action has alleviated some apprehensions, it’s crucial to note that a significant percentage of the company’s shares, approximately 5.66%, are still under pledge. Managing the remaining pledged shares will be pivotal for SMS Pharma’s future stability and investor confidence. More information can be found on moneycontrol.

3. Financial Performance Analysis:

SMS Pharma’s financial performance has been a rollercoaster ride in recent years. Profits plummeted from ₹68 crore in 2022 to a mere ₹4 crore in 2023. However, the company has remained consistent in its dividend payouts despite fluctuating profits. In 2022, it paid out a 4% dividend, while in 2023, it maintained a dividend payout ratio of 62%. This remarkable consistency in dividends reflects SMS Pharma’s commitment to shareholders even during challenging times.

4. Outlook and Conclusion:

Looking ahead, SMS Pharma appears poised for significant developments. The surge in stock price and trading volume, coupled with strategic moves by the promoters and improving financial performance, paint a promising picture for the company’s future. Investors may find SMS Pharma an intriguing prospect, with the potential for further growth and value creation in the pharma sector. However, vigilance regarding pledged shares and ongoing market dynamics will be crucial in navigating the company’s journey forward.

Disclaimer : This is not a financial advice, do your own research before investing. For more updates visit stoxinsight.