Different stories in standalone and consolidated financials: SAB industries limited

Introduction

In the vibrant realm of the Indian construction sector, SAB Industries Limited has emerged as a notable player, commencing its operations in the year 1996. Renowned for its offerings in Road Construction, Building Construction, and Civil Construction, the company has steadily etched its mark in the industry landscape.

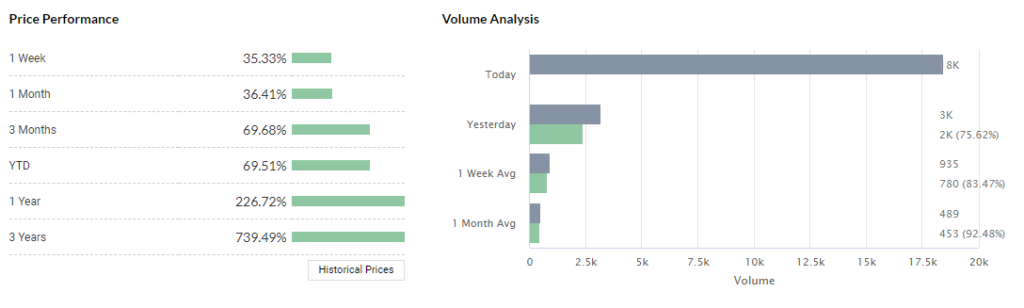

Surge in Stock Price: A Closer Look

Recent market movements have thrust SAB Industries Limited into the spotlight, with its stock price surging by an impressive 20% in a single trading day. Despite its modest market capitalization of 377 crore, the company has demonstrated commendable performance, accruing profits totaling 66 crore from March 23 to December 23.

Analyzing Valuation Metrics

One of the metrics that has garnered attention from experts and investors alike is the company’s Price-Earnings (PE) ratio, standing at a healthy 5.74. This valuation suggests promising growth prospects for SAB Industries Limited. However, a deeper dive into the financials reveals intriguing nuances.

A Peculiar Anomaly: Negative Profits from Operations

Despite the favorable PE ratio, the company has reported negative profits from operations for the past four consecutive years. Instead, profits have been derived from other income sources. In the third quarter of 2023, SAB Industries Limited incurred a significant loss from operations, raising questions about the sustainability of its business model.

Standalone Financials vs. Consolidated Financials

The discrepancy in financial performance becomes more pronounced when comparing standalone and consolidated financials. While the consolidated figures paint a relatively optimistic picture, showcasing stability in shareholding patterns, the standalone metrics present a starkly different narrative, with a sky-high PE ratio and subdued Return on Equity (ROE).

Conclusion: Navigating Investment Decisions

The meteoric rise of SAB Industries Limited juxtaposed with its financial intricacies underscores the importance of diligent analysis before making investment decisions. While the company exhibits strengths and promising prospects, investors must exercise caution and delve deeper into its financial performance to decipher the underlying truths behind the numbers. More details could be found on www.bse.com

Disclaimer: This is not a financial advice, Do your research before investing. For our other articles visit https://stoxinsight.com