A SMALL CAP COMPANY WITH 6 TIMES RISE IN DEBT IN ONE YEAR : MEGASOFT LIMITED

Introduction:

Megasoft Limited, a prominent player in the tech industry, with a strong focus on the telecom sector, has been making significant strides. The company’s operations extend across multiple countries including India, U.S., UK, Singapore, Malaysia, and Germany.

Financial Performance:

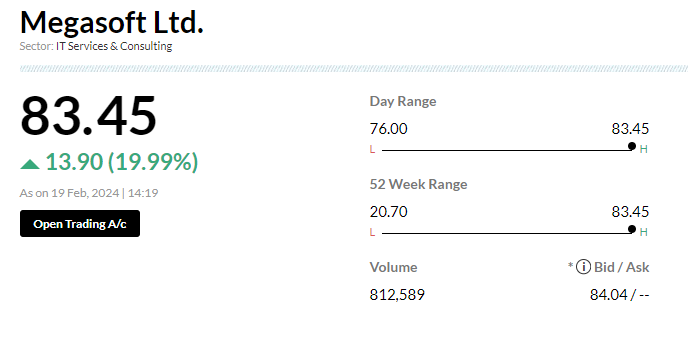

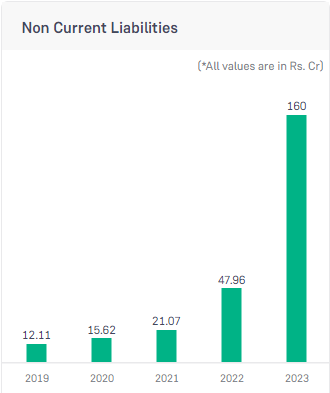

The latest update for small cap stocks reveals that Megasoft’s valuation has witnessed a remarkable 20% surge, now standing at an impressive 620 crores, reaching a 52-week high. Investors have been drawn to the company with a 27% return within a week and an outstanding 150% return over the past year. Additionally, trading volume has increased six fold, indicating a surge in investor interest. However, there has been a significant development in Megasoft’s long-term debt, which has grown six times from 23.97 crores in 2022 to 138.09 crores in 2023.

Revenue and Profit Analysis:

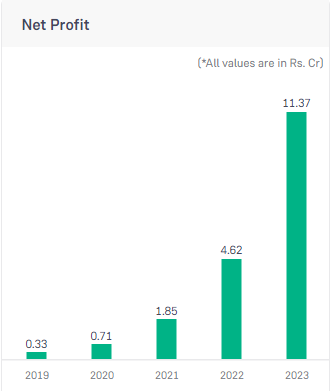

Despite facing challenges, Megasoft has seen a transformation in its revenue streams, with a decline in net sales by 45%, but a notable increase in revenue from other streams. The company has managed to achieve a remarkable profit surge, with net profit soaring by 150% from 4.62 crores in 2022 to 11.37 crores in 2023.

Shareholding Pattern:

Megasoft has maintained stability in its shareholding structure, with promoters consistently holding a 43.77% stake in the company. Furthermore, there has been institutional interest in the company, with Domestic Institutional Investors (DIIs) acquiring a 0.12% stake in Q3 2024.

Future Outlook:

Looking ahead, Megasoft is well-positioned to benefit from the latest advancements in the telecom sector, particularly with the upcoming introduction of 5G technology. The company’s commitment to innovation and strong industry leadership positions it as a key player in the market. Further information for this company can be found on https://www.nseindia.com/get-quotes/equity?symbol=MEGASOFT

Conclusion:

In conclusion, Megasoft Limited continues to exhibit resilience and strategic foresight in navigating the challenges of the tech industry. With a strong foundation, stable shareholding pattern, and a focus on innovation, the company is poised for continued growth and success. Investors and industry watchers are encouraged to closely monitor Megasoft’s journey as it continues to make waves in the tech sector.

Disclaimer: This is not a financial advice, Kindly do your own research before making any decision.

1 Comment

[…] For more interesting blogs visit http://www.stoxinsight.com […]