Small cap stock to look for: Emmbi Industries Ltd

Introduction:

Emmbi Industries Ltd, a leading player in the industrial packaging solutions sector, presents its latest stock update and financial insights for the third quarter of fiscal year 2024 on February 14th, 2024. This comprehensive report highlights Emmbi’s impressive profitability, significant market resonance, and recent advancements, showcasing its journey toward sustained excellence.

Financial Performance:

Emmbi Industries Ltd, a small cap company in focus, has showcased remarkable agility and operational finesse with its quarter-to-quarter profit growth. The company’s profits surged from Rs. 1.61 crore in September 2023 to Rs. 2.37 crore by December 2023, marking a substantial upswing within a single quarter. However, it is worth noting that Emmbi experienced a significant decline of 56% in its annual profits compared to the previous fiscal year. Despite this, deeper exploration into the factors driving this variance is essential to understand the company’s trajectory.

The complete financials can be found on NSE website at below link –

https://www.nseindia.com/get-quotes/equity?symbol=EMMBI

Market Performance:

As of February 15th, 2024, Emmbi Industries Ltd’s stock witnessed a modest decline of 3.76%, trading at Rs. 114.15 per share at 13:14. Nonetheless, the company has demonstrated an impressive growth rate of 24% over the past year, reflecting investor confidence and market resilience. With a Price/Earnings (PE) ratio of 28.22 and an Earnings per Share (EPS) of Rs. 4.05, Emmbi offers a compelling investment proposition. Furthermore, a Price/Sales ratio of 0.37 and a Price to Book ratio of 1.30 further bolster the company’s promising market valuation.

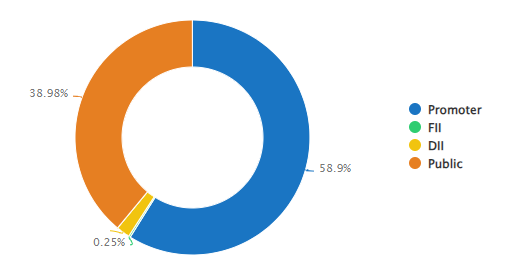

Shareholding Pattern:

Emmbi Industries Ltd has recently witnessed a notable shift in its shareholding landscape, with reduced stake from Foreign Institutional Investors (FIIs) from 7% to 0%. On the other hand, retail investors have increased their ownership from 32.7% to 38.9%. This transition signifies changing sentiments among investors and highlights the growing confidence of retail investors in the company’s future prospects.

Recent Developments:

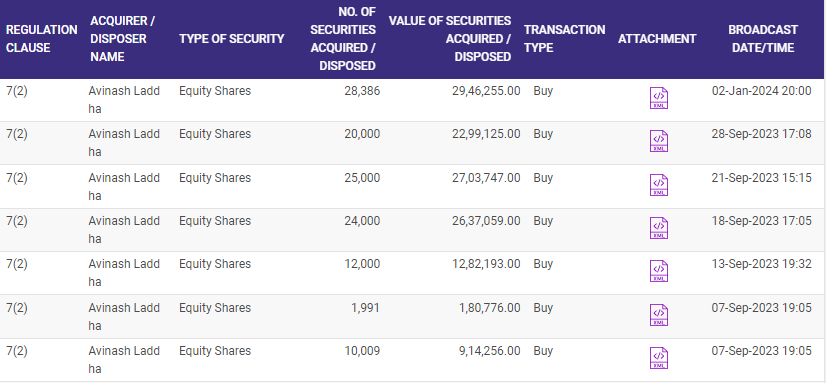

An intriguing development in Emmbi’s narrative is the disclosure of significant share purchases worth 1,27,83,218 by Mr. Avinash Ladha under regulation clause 7(2) of SEBI. This move not only indicates insider confidence but also serves as a testament to Emmbi’s strategic vision and market potential.

Conclusion:

Emmbi Industries Ltd’s latest stock update and Q3 FY24 financial report reveal resilience, innovation, and unwavering commitment to value creation. While the company continues to enjoy impressive quarter-to-quarter profit growth and a resilient stock performance, the decline in annual profits calls for thorough introspection and strategic recalibration. However, amidst these considerations, Emmbi remains steadfast in its dedication to drive growth and deliver value to its stakeholders, paving the way for a future brimming with promise and possibilities.

Disclaimer:

This report offers insights into Emmbi Industries Ltd’s financial landscape and recent developments for informational purposes only. It is strongly recommended that readers conduct thorough research and seek professional advice before making any investment decisions.