159% listing gains, new company acquisition and a 138 P/E!

- A Remarkable Debut:

- Opening at a 159% Premium: The company made an impressive entry into the stock market, with its initial public offering (IPO) generating significant investor interest. On the day of its debut at the National Stock Exchange (NSE), Australian Premium Solar Limited’s stock price opened at a remarkable 159% premium compared to its issue price, indicating strong demand and investor confidence.

- Current Stock Price and Daily Surge: As of the latest trading session, the company’s stock is trading at Rs. 232 per share. Moreover, the stock witnessed a notable surge of 5% in a single trading day, reflecting the market’s positive response to the company’s prospects.

- Market Capitalization and Valuation:

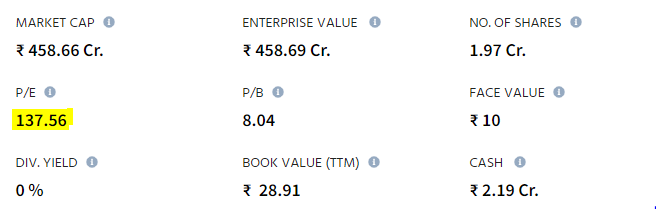

- Mcap Reaches Rs. 459 Crore: The meteoric rise in Australian Premium Solar’s stock price has propelled its market capitalization to a staggering Rs. 459 crore, marking a significant milestone for the company and highlighting its growing prominence in the industry.

- Elevated PE Ratio of 138: Despite the impressive stock performance, scrutiny of its price-to-earnings (PE) ratio reveals a rather elevated valuation, standing at a lofty 138 based on current figures. This indicates that investors are willing to pay a premium for the company’s growth potential.

- Financial Performance:

- Modest Profit in September 2023: Australian Premium Solar reported a modest profit of only Rs. 2.6 crore in September 2023, suggesting a relatively small scale of operations. While the company’s financials may not yet reflect its full potential, its entry into the stock market has provided it with the necessary capital to fuel its growth ambitions.

- Strategic Acquisition:

- Incorporating a New Fully Owned Subsidiary: Recent developments suggest a potential shift in Australian Premium Solar’s trajectory. The company has disclosed an acquisition of a new company through a filing with the NSE. This strategic move involves incorporating a fully owned subsidiary under its parent entity, with the aim of leveraging synergies and unlocking growth opportunities in the solar energy sector. The Official letter can be found here.

- Potential Benefits and Market Sentiments: While details regarding the acquisition remain sparse, market sentiments have responded positively to the announcement, driving the stock price upward. Investors are optimistic about the potential benefits that the acquisition could bring, signaling the company’s intent to expand its market presence and diversify its offerings.

- Caution Amid Excitement:

- Need for Vigilance and Long-Term Assessment: Despite the initial excitement surrounding the acquisition, it’s essential for investors to exercise caution and monitor the company’s performance closely in the coming quarters. While the acquisition holds promise for Australian Premium Solar, the true impact of this strategic move will only materialize over time. Therefore, investors should remain vigilant and assess the long-term implications of the company’s decisions on their investment portfolios.

Disclaimer : This is not a financial advice, do your own research before investing. For more such articles visit stoxinsight.